9 Easy Facts About Clark Wealth Partners Shown

Facts About Clark Wealth Partners Uncovered

Table of ContentsThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutOur Clark Wealth Partners IdeasHow Clark Wealth Partners can Save You Time, Stress, and Money.Excitement About Clark Wealth PartnersFascination About Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is Talking About10 Simple Techniques For Clark Wealth Partners

These are specialists that supply investment recommendations and are signed up with the SEC or their state's safety and securities regulator. NSSAs can assist senior citizens make choices concerning their Social Security benefits. Financial advisors can also specialize, such as in student financings, senior demands, taxes, insurance and various other facets of your finances. The accreditations required for these specializeds can differ.But not constantly. Fiduciaries are legitimately called for to act in their customer's finest rate of interests and to keep their cash and property separate from various other properties they take care of. Only economic consultants whose designation calls for a fiduciary dutylike licensed financial coordinators, for instancecan state the same. This distinction also suggests that fiduciary and financial consultant fee frameworks vary too.

Some Known Details About Clark Wealth Partners

If they are fee-only, they're a lot more likely to be a fiduciary. Numerous qualifications and designations call for a fiduciary task.

Picking a fiduciary will certainly guarantee you aren't steered toward particular financial investments due to the compensation they offer - financial advisor st. louis. With great deals of cash on the line, you might desire an economic professional that is lawfully bound to make use of those funds meticulously and just in your ideal interests. Non-fiduciaries may suggest investment items that are best for their pocketbooks and not your investing objectives

Clark Wealth Partners Things To Know Before You Buy

Boost in financial savings the typical house saw that functioned with a financial expert for 15 years or more contrasted to a comparable house without a monetary expert. "A lot more on the Worth of Financial Advisors," CIRANO Task Reports 2020rp-04, CIRANO.

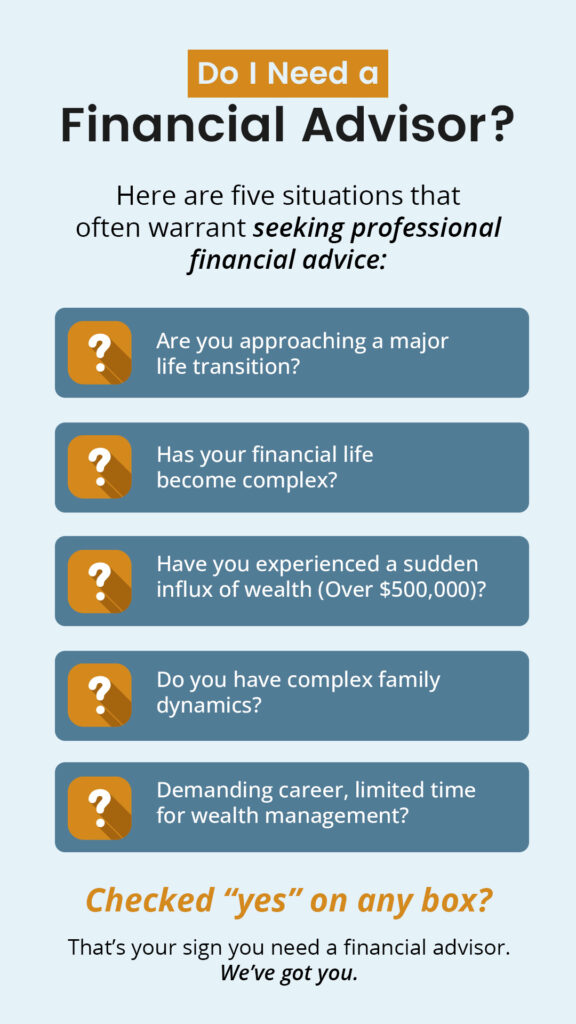

Financial suggestions can be helpful at transforming factors in your life. Like when you're beginning a household, being retrenched, preparing for retired life or taking care of an inheritance. When you consult with an advisor for the very first time, exercise what you desire to obtain from the guidance. Before they make any type of referrals, a consultant needs to put in the time to discuss what is very important to you.

The Basic Principles Of Clark Wealth Partners

Once you have actually agreed to go ahead, your monetary consultant will prepare a financial strategy for you. You ought to always feel comfy with your consultant and their recommendations.

Insist that you are alerted of all deals, and that you receive all document relevant to the account. Your advisor may recommend a taken care of discretionary account (MDA) as a means of managing your financial investments. This includes signing an agreement (MDA contract) so they can buy or offer investments without having to contact you.

9 Simple Techniques For Clark Wealth Partners

To shield your money: Don't provide your adviser power of attorney. Firmly insist all document about your financial investments are sent out to you, not just your adviser.

If you're moving to a new advisor, you'll need to set up to move your economic records to them. If you require assistance, ask your advisor to discuss the procedure.

will retire over the following decade. To fill their footwear, the nation will require more than 100,000 new economic consultants to enter the industry. In their everyday work, monetary consultants handle both technological and imaginative jobs. U.S. Information and World Record rated the function amongst the leading 20 Ideal Organization Jobs.

See This Report about Clark Wealth Partners

Assisting people achieve their economic objectives is an economic advisor's primary function. They are additionally a small organization owner, and a portion of their time is committed to handling their branch office. As the leader of their technique, Edward Jones financial experts require the leadership skills to hire and handle personnel, go right here in addition to business acumen to create and execute a company method.

Financial advisors spend some time on a daily basis viewing or checking out market information on television, online, or in profession publications. Financial consultants with Edward Jones have the advantage of office research study teams that aid them keep up to date on stock suggestions, common fund administration, and more. Investing is not a "set it and neglect it" activity.

Financial consultants ought to set up time weekly to fulfill new people and overtake individuals in their ball. The monetary solutions sector is greatly managed, and guidelines alter usually - https://www.empregosaude.pt/author/clrkwlthprtnr/. Several independent economic consultants spend one to 2 hours a day on compliance activities. Edward Jones economic consultants are fortunate the office does the hefty lifting for them.

10 Simple Techniques For Clark Wealth Partners

Edward Jones economic experts are urged to pursue added training to widen their understanding and skills. It's likewise an excellent idea for economic advisors to go to market seminars.